Bret Dixon Insurance News

Our newsletters are intended to keep you up to date on

pertinent industry news and offer more in-depth insight into various

types of coverage and endorsements. We publish our newsletters

at least once each quarter. We hope you enjoy it.

Thank you for your patronage!

|

|

|

Brace for Rising Homeowners Prices

The $65

billion homeowner product industry is approaching a financial

crossroads

and carriers will need to make changes. Industry-wide loss

information indicates that over the last 30 years, the return on the

homeowners product line has been less than the cost of capital.

Over the last 25 years, the industry's "combined ratio" has

been 112%. That means for every $1 collected in premium,

carriers have paid out $1.12. Extrapolate that out over $65

billion and you'll find yourself staring at some ugly math. crossroads

and carriers will need to make changes. Industry-wide loss

information indicates that over the last 30 years, the return on the

homeowners product line has been less than the cost of capital.

Over the last 25 years, the industry's "combined ratio" has

been 112%. That means for every $1 collected in premium,

carriers have paid out $1.12. Extrapolate that out over $65

billion and you'll find yourself staring at some ugly math.

This is the

crisis that homeowners insurers are now faced with, and it's only

been worsened by a record year for destructive weather and natural

disasters in 2011.

The market for

homeowners is changing, and it's going to

continue to change. Consumers can probably

get some idea of this just by turning on the evening news.

Catastrophes have played a role - both in the U.S and around the

globe - but they're not alone. A struggling economy has played

a role as well.

For a segment

of the insurance industry that was already losing money, it certainly

didn't help that:

- The first half of 2011 saw 43 major

thunderstorms, which released 1600 tornadoes across the U.S.,

with 226 verified tornadoes striking in one day (4/26/11)

- Thunderstorm losses reached a record 23.6

billion in financial losses

- Through just the first six months, 2011

was already the highest loss year on record globally

- The northeastern U.S. experienced a

tornado, earthquake, hurricane and a significant pre-Halloween

snowstorm all in the same year.

- Through just October 3rd, the number of

federal disaster declarations set a new record in 2011, with 90

And economic

pressures contributed to a crushing year as well, through:

- Decline in investment yield, putting

greater pressure on underwriting income

- Loss cost increases - with a tougher

economy comes an increase in frequency of smaller losses

- With fewer new homes being built,

construction costs have increased due to economic pressures and

recession.

- Increased oil prices tend to drive up the

costs of asphalt shingles, which are used by about 66% of U.S.

homes.

- Limited exposure growth, due to a troubled

housing market and recession

So brace

yourselves for increased premiums and other changes on your

homeowners policies. We've written before about tightening of

Replacement Cost requirements and closer monitoring of loss

history data. Now, some companies are faced with tough

decisions like increasing rates, tightening underwriting requirements

and eligibility, enacting coverage changes to cut coverage or even

pulling out of the homeowners market - in totality, or just segments.

As an agent,

there are a few things we can do to mitigate increases. For

one, conducting a review of your homeowners - running a current

replacement cost estimator, looking for any potential discounts that

may be available. We can try and bundle or package your other

policies to maximize multi-policy discounts by putting your auto,

personal articles, boat or umbrella with the same carrier as your

home. We can talk about increasing your deductible. Those

things can help, but unfortunately, there's no getting around rate

increases. They're coming; It's 2012, not 2002. Times are

different, and as we're seeing, homeowners rates are different too.

|

|

Food Handlers Guidelines in

the Prevention of Foodborne Illnesses

Every once in awhile we'll see a food contamination

claim.

They're

pretty rare, but when they do happen, they tend to be costly, as tens

or possibly even hundreds of patrons could be affected.

Moreover, not only are those patrons made ill, but word of

mouth will surely get around about the incident, possibly turning

would-be patrons off and cutting down the number of customers

coming in your door. Furthermore, your business must follow

strict Health Department guidelines before being allowed to re-open,

which could include disposal of all or some foods, thorough cleaning

and sanitizing of your kitchen and possibly even having employees

vaccinated. With that in mind, here's the Food Handlers

Guidelines in the Prevention of Foodborne Illnesses, courtesy of

AmTrust North America, one of our valued companies (more info to the

right). They're

pretty rare, but when they do happen, they tend to be costly, as tens

or possibly even hundreds of patrons could be affected.

Moreover, not only are those patrons made ill, but word of

mouth will surely get around about the incident, possibly turning

would-be patrons off and cutting down the number of customers

coming in your door. Furthermore, your business must follow

strict Health Department guidelines before being allowed to re-open,

which could include disposal of all or some foods, thorough cleaning

and sanitizing of your kitchen and possibly even having employees

vaccinated. With that in mind, here's the Food Handlers

Guidelines in the Prevention of Foodborne Illnesses, courtesy of

AmTrust North America, one of our valued companies (more info to the

right).

Foodborne illnesses are caused by the ingestion of

contaminated foods. The widespread and multiple nature of

foodborne disease outbreaks can represent costly and potentially

serious illness, business interruption and, in some instances,

adverse publicity. This bulletin is to assist food serving

establishments in the development and enhancement of food-handling

practices.

Methods most crucial in preventing the transmission

of food borne illnesses include TEMPERATURE CONTROLS,

PERSONAL HYGIENE, WASHING AND SANITIZING, AND FOOD PROTECTION.

Since agents causing food borne illnesses can occur

naturally, proper temperature controls are the only means by which

many of these can be destroyed. Agents can also be introduced

by substandard personal hygiene, sanitizing and food protection

practices. In order of their relative importance, methods of

prevention are as follows.

Temperature control deficiencies account for

approximately 90 percent of all food

borne illness cases.

Thermometers are needed to be sure

that refrigeration and hot holding units are working

properly. The danger zone under which microbiological agents

can reproduce is between 45 and 140 degrees Fahrenheit.

Probe thermometers should be used consistently to check core

temperatures of cooked meats and stored foods.

Thermometer ranges should be from 40 through 170

degrees Fahrenheit. A functional thermometer should be in

each unit. The following types of temperature control methods

and procedures should be followed.

Keep all cold food at 45 degrees Fahrenheit or cooler

(the US Food & Drug Administration is considering 41 degrees as a

future standard). Check temperatures with a probe thermometer.

Chill all foods to below 45 degrees before putting them on ice

which should maintain that temperature. Place containers in ice

up to the level of food.

Hold hot food at 140 degrees or hotter. Check

temperature with a core thermometer. Cook foods to a 165 degree

core temperature before placing in hot holding units and preheat the

holding unit to 140 degrees before placing food inside.

Rapidly reheat foods to 165 degrees or hotter before

serving them again. This minimizes the reproduction of

biological agents. Stir often to ensure even heating.

Check temperatures with a probe thermometer. Equipment

such as steam tables, crock pots, or steamers that cannot reheat

foods rapidly should not be used.

Improper cooling is the number one cause of foodborne

illnesses. All foods must be cooled to below 45 degrees within

less than four hours. The cooling of solid and liquid food should

utilize the shallow pan method, as follows:

- Use

shallow pan less than four inches deep

- Refrigerate uncovered

while food is still hot

- Use

probe thermometer to check temperature

- Stir

often to ensure even and more rapid cooling

- Store

on high shelf so nothing can fall into pan

- Place

a metal pan of hot food in large food sink with the drain closed

- Fill

the sink with ice to the level of food in the metal pan

- Add

cold water to ice

- Stir

to cool food evenly

- Add

more ice as original ice melts

- Check

temperature with probe thermometer

- Cool

to less than 45 degrees within four hours

- Put

food in refrigerator

Do not thaw potentially hazardous foods (meat, dairy products,

eggs) at room temperature or in warm water. Three approved methods

include:

- Thawing

in refrigeration units

- Thawing

under cold running water in prep sink

- Thawing

in a microwave followed by immediate cooking or serving

Remember the danger zone for microbial contamination

is temperatures between 45 and 140 degrees Fahrenheit.

Substandard personal hygiene is the second leading

cause of foodborne illnesses. Hands that are not clean pass

bacterial, viral, parasitic, and chemical agents to foods.

Precautions are as follows:

Wash hands often in approved sinks (not prep or

dishwashing sinks) and use warm water and soap and always wash hands

after:

- Using

the rest room

- Smoking

- Touching

raw meat

- Coughing

or sneezing

- Touching

money or dirty things; and

- Between

handling dirty dishes and clean ones

- Before

touching food, utensils, and equipment

Dry hands with an air dryer or on clean towels of

paper or roller linen. Aprons, clothing or cloth hand towels should

not be used for drying hands.

Cuts, Wounds and Abrasions

Hands should be checked for any infected wounds.

Infected wounds are generally red and may ooze pus. If infected, do

not work with food, utensils, or equipment. Non-infected cuts should

be bandaged and the hand covered with a waterproof, leakproof,

tight-fitting plastic glove.

Employees should not allow individuals sick with

colds, influenza, diarrhea, vomiting, sore throats, or runny noses to

work. Importantly, individuals with infectious our communicable

diseases should not work around food. Illness reporting requirements

should be established.

Hair should be kept under control during food

preparations, preferably in a net. Clean clothing and regular

bathing as well as clean work habits should be followed.

Dishes and utensils need to be sanitized. Careful

washing precedes sanitizing. Washing and sanitizing can be done

either by hand or machine.

Hand washing should include the following (three sink

method):

- Scrape

and/or pre-rinse food from dishes and utensils.

- Wash

with detergent and hot (120 degree) water in the first sink.

- Rinse

with clean hot water to remove any soap or food in the middle

sink.

- Sanitize

in the third sink with a ratio of one teaspoon bleach to one

gallon of clean warm water. Other EPA and Health Department

approved chemical sanitizers can be used. Use proper ratios as

excess concentrations can leave residue and cause illness.

- Air

dry dishes and utensils. Towel drying can spread germs.

Machine washing should use the following guidelines:

- Scrape

and/or pre-rinse food from dishes and utensils.

- Follow

manufacturer's directions and utilize full utensils.

- Hot

water rinse machines should wash at 150 degrees and rinse at

temperatures of at least 180 degrees.

- Chemical

spray rinses should utilize wash water at 120 degrees and rinse

temperature no lower than 75 degrees in a 50 part per million

bleach solution (1 tsp/gallon).

- Air

dry dishes and utensils.

- Cracked

or worn dishes should be discarded since they provide a porous

media for bacterial growth.

All equipment that touches food that cannot fit in the

dishwasher should be washed and sanitized regularly. This includes

washing and sanitizing equipment before it is used on another piece

of food. Equipment used constantly should be broken down, washed, and

sanitized every two hours.

Equipment that is too big to fit in a sink or

dishwasher should be:

- Washed

with a clean cloth and warm soapy water.

- Rinsed

with clean water.

- Sanitized

with a solution of one or two teaspoons of bleach per gallon of

water.

Always rinse or sanitize any food preparation surface

or equipment between using it for raw and cooked food or between

different foods. One recent study suggests that wooden cutting boards

are preferred to synthetic types. Recent research suggests wood has

natural chemicals that destroy or control bacterial growth.

- Wash,

rinse and sanitize sinks before using them to prepare food or

for dishwashing.

- Never

wash hands in food preparation or dishwashing sinks.

- Never

put mops or other cleaning equipment in food preparation or

dishwashing sinks.

Wiping cloths should be kept in a clean sanitizing

solution. They should be used to wipe all kitchen and dining surfaces,

including cutting boards, prep counters, tables and work tables.

Sanitizing solutions are one teaspoon bleach to one gallon water.

Cloths should be rinsed before placing them in a sanitizing solution

and laundered regularly.

Stored foods must be protected from contamination. All

foods must be stored (except foods being cooled). Food stored in

rooms or walk-in units should be at least six inches above the floor.

Always store raw meat, poultry, and fish in leakproof containers on

the bottom shelf. If one container of food has to be stacked on the

other, make sure the bottom container has a sealed cover. Never stack

hot foods, as this slows and prevents even cooling.

Foods should be touched with fingers or hands as

little as possible. When this is necessary, ensure that hands and

fingers are clean. Use tongs, scoops, or utensils whenever possible.

- Gloves

should not be a substitute for hand washing

- Gloves

must be used only once and discarded

- Gloves

should be used only when utensils cannot be used

- Gloves

can transmit germs

- Kevlar

gloves should be washed and sanitized whenever changes in food

species occur

When preparing large quantities of food, remove only a

small amount at a time from the refrigerator or hot holding unit and

keep the rest of the food at desired temperatures.

All chemicals and cleaners must be stored below and

away from food, preferably in their own cabinets or rooms. Chemicals

and cleaners must be labeled and stored in their own containers.

Self-Service Buffet/Open Food

Lines

Open displays must be covered or have sneeze guards.

Monthly and/or as-needed pest control service program

must be in place. Insect and rodents seen should be immediately

reported to supervisors and the pest control service as this signals

the need for more cleaning and maintenance.

Trash and garbage should be stored away from food in

covered containers.

All foods should come from licensed (reputable)

suppliers. It should be prepared in approved locations and not be

cooked at home or brought to work.

|

|

Spotlight On: Property Insurance

The Three Deadliest Sins:

Coinsurance, Protective Safeguards & Vacancy Provisions

Client 1: "Our furnace malfunctioned last week

causing smoke damage to our building, machinery and inventory. We

already paid our deductible, but now the insurance company is telling

us that they will only pay for one-half the damages."

Client 2: "My building burned down last

month, but now the insurance company refuses to pay for the fire loss

because the fire sprinkler valve was not chained and locked in the

full-open position."

Client 3: "My company occupies three

offices in our building and has placed the remaining nine offices up

for rent. Yesterday we discovered that a pipe had broken over

the weekend and water leaked through all three floors. Our insurance

company refuses to pay the claim since the building was not

"sufficiently occupied" at the time of the loss.

Many insureds are surprised to learn that their

insurance policies include hidden penalty clauses buried deep within

the fine print. Insurance companies are quick to invoke these clauses

in order to reduce or deny coverage following a loss.

Here we'll review the three main penalty clauses found

in most property policies and discuss how these clauses ultimately

affect coverage.

What do you mean the insurance

company is only going to pay for one-half of the damages?

A coinsurance clause allows the insurance company to

reduce the amount of their property settlement if, in

their opinion, you did not maintain adequate insurance values at the

time of a loss.

Most policies that include a coinsurance provision

will display a coinsurance percentage on the declarations page.

80% is the most common amount. At a minimum, this percentage is

the proportion of the replacement value that the insured promises to

maintain.

Put another way, the insured is promising the

insurance company that it will maintain insurance values of at least

80% of the actual replacement cost of the property. As long as

the insured keeps their promise, there is no penalty.

On the other hand, if the insured did not maintain an

insurance value of at least 80% of the actual replacement cost, the

insurance company will reduce the amount of their loss settlement in

proportion to the amount they were underinsured.

|

|

|

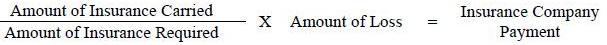

Coinsurance Loss settlement formula

|

Since a

pre-loss replacement cost value is nearly impossible to calculate

with any degree of certainty, the insurance company will always try

to reduce their loss payment based on their own post-loss assessment

of the replacement cost.

By way of

example, assume that you suffer a $300,000 fire loss under a property

policy that has a building limit of $500,000. After the loss,

the insurance company determines that the actual replacement cost of

the building was $1,000,000, not the $500,000 that you insured.

In this case, the policy holder only insured 50% of the actual

replacement cost when they should have maintained at least 80%.

The insurance company will then reduce their loss settlement by the

amount the policyholder was underinsured. For a $300,000 fire

loss, the insurance company would only pay $187,500.

A

sample coinsurance provision reads as follows:

But

my insurance agent told me that I don't have a coinsurance clause and

my policy says that I have a "blanket limit." Does

this mean I am covered?

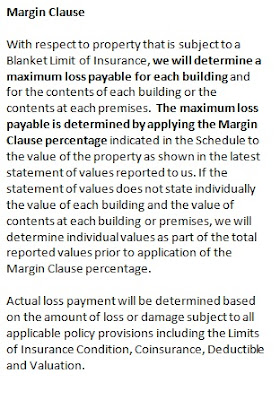

Instead of a

coinsurance provision, some policies include what is called a

"margin clause." This language can be quite deceiving

in that it often leads the insured to believe that they have a

blanket limit of insurance that can be applied to any location.

This is not the case.

A margin

clause allows the insurance company to limit the amount of coverage

available for each location by a certain percentage, despite any appearance

of a blanket limit. For example, if the policy shows an insured

value of $300,000 and it actually costs $500,000 to rebuild the

structure, the most an insurance policy with a 20% margin clause will

pay is $360,000 (i.e. 120% of $300,000) even if there is a $2,000,000

blanket limit.

A

sample margin clause is as follows:

|

|

|

Margin Clause

|

Since

replacement costs vary depending on the construction costs and

material availability, it would be ideal to find a

property policy that does not include a coinsurance

provision or a margin clause.

But my

insurance agent promised me that the margin clause would not apply to

certain properties even though the policy seems to say otherwise.

Without citing

all kinds of cases, the policy takes precedent. Which is why we

always suggest reading your policy. Statements made by

insurance agents are not binding upon the carrier. Regardless

of what was said, the policy must be enforced in accordance with its

terms.

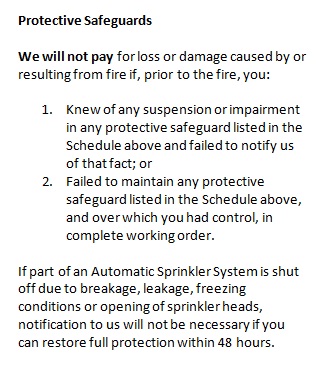

Protective

Safeguards

Do not be

fooled. The policy holder is not the one being protected by a

"protective safeguards provision."

A protective

safeguards provision allows the insurance company to deny coverage if

certain conditions are not satisfied at the time of loss. For

example, if the fire sprinkler system does not operate properly,

there is no coverage. If the burglar alarm system does not go

off, there is no coverage. If the smoke detectors do not work,

there is no coverage, and so on.

A common

protective safeguards provision that is included in most property

policies is included below.

|

|

There

are many different types of Protective Safeguard Exclusions

|

In a case

called Burmac

Metal Finishing Co. v. West Bend Mut. Ins. Co., the

insurance company denied coverage for damage caused to the insured's

building after a natural gas explosion based on the insured's failure

to properly maintain its automatic sprinkler system as required by

the protective safeguards endorsement to the policy.

In other

cases, insurance companies have attempted to deny coverage if the

water valve for the fire suppression valve was not chained in the

full open position prior to the loss.

As with

coinsurance, a protective safeguards endorsement is a dangerous part

of your policy. In some instances, they may be unavoidable.

But avoid them if you can.

Vacancy

A vacancy

clause allow the insurance company to reduce or deny coverage if the

structure was not sufficiently occupied at the time of a loss.

Most vacancy

clauses limit coverage as follows:

|

|

|

Vacancy - click to enlarge

|

In one

instance found, the insurance carrier denied all coverage since the

rental property was vacant for more than 60 days prior to it being

destroyed by a fire. Under the terms of the policy the property

owner was not entitled to insurance benefits because the policy did

not offer coverage for properties vacant for over 60 days.

In a second

case on the subject, the insurer denied coverage for an $800,000

water damage claim from a pipe break since less than 50% of the total

square footage of the building was occupied at the time of the loss.

As with the

prior two property coverages, a vacancy clause on your policy is not

ideal. However, good luck finding an insurer nowadays who won't

put the endorsement on your policy.

The

bulk of this article first appeared in the Cambridge Property &

Casualty Report, written by Daniel P. Hale, J.D., CPCU, ARM, CIC,

AAI, LIC, AIC, AIS, API, AU.

|

|

Illinois Gaming Update

Earlier this summer the Illinois Gaming Board  began

taking applications online for gaming licenses. Prior copies of

applications have circulated around these last few years as Illinois

moved closer to adopting legalized video game gambling. Last

August, we passed along some tips to

help you prepare for the very thorough document and background check

the Illinois Gaming Board has. began

taking applications online for gaming licenses. Prior copies of

applications have circulated around these last few years as Illinois

moved closer to adopting legalized video game gambling. Last

August, we passed along some tips to

help you prepare for the very thorough document and background check

the Illinois Gaming Board has.

But now the IGB is taking applications and some

machines could begin going into circulation in a matter of

weeks. The app can be found at https://www.igb.illinois.gov/vla/.

Here are some things to keep in mind as you prepare to file your

application:

- Having

the first application in does not mean first application

approval. The IGB conducts an exhaustive review of

applicants and that process may take longer with some applicants

than others.

- Make

absolutely sure that information is accurate and truthful.

- You

cannot submit your application, withdraw it, and resubmit

it. It has to be right the first time.

- It's

recommended that applicants have another set of eyes look over

their application before submitting to verify the completeness

of the app.

We know this

is a law many of you have been watching closely and anxiously

awaiting the passage of. We'll pass along any further

information on this subject as it comes out.

|

|

Why An Older Building

Isn't Always Cheaper to Insure

We'll occasinally get a comment to the effect of,

"my building is really old, it's not in great shape, shouldn't

it cost less to insure than a new building?" Determining

the Replacement Cost of the structure depends on it's size,

construction and characteristics. But delving deeper, why might

an older building have a higher rate with an insurance company than a

newer one?

In short, because older buildings can mean greater

risk.

One of our carriers recently tackled this in one of

their regular publications, and it seemed fitting to pass the info

along in ours.

Many older buildings are just not as good of an

insurance risk (to a carrier) as newer properties. The problems

outlined below and in combination with each other make it much more

difficult to underwrite the profitabliliy. Here's why:

1. Older buildings may not be optimal for

occupancy, and may even be obsolete. This reduces the value of

the building to the insured and discourages investment in

improvements and maintenance.

2. Older buildings often come with older wiring,

plumbing, heating, roofing and mechanicals. Even if updated,

there are still some older components that can contribute to a loss.

3. Older buildings can commonly be found in

central city areas where the crime and vandalism exposure can be

higher than suburban areas.

4. Surrounding buildings may be substandard (due

to their age and deterioration) or have vacancies. Even if they

do not directly expose the insured building, these neighborhoods may

drag down the market value of the insured property.

5. Older properties are genearally not as

profitable as newer buildings because they cannot command higher

rents. With a lower profit margin, management sometimes is not

willing to invest in maintenance and improvmeents. They either

can't do these updates or may make a conscious decision to forgo

maintenance expenses when there is limited return on investment.

6. Tenants may not be optimal and mean a greater

credit risk or character risk. Vacancies can create a financial

strain and encourage building owners to rent to less desirable

tenants.

7. Private protection, like fire and burglar

alarm systems, are usually older and less reliable.

8. The (replacement cost) values in older

buildings are inadequate more often than on newer properties.

This may cause insurance-to-value problems.

9. Older buildings are commonly remodeled at one

time or another. The oldest buildings may have undergone many

changes in occupancy and remodeling. This can be a good thing,

but it may create problems like concealed spaces, updates done by

unqualified professionals and traffic flow issues (foot traffic, in

case of emergency evacuation from the building).

|

|

Claim Reviews: Subrogation

Horrors

Subrogation is the substitution of one person in the

place of another with reference to a lawful claim, demand or right,

so that he or she who is substituted succeeds to the rights

of the other in relation to the debt or claim, and it's rights,

remedies or securities.

In insurance matters, subrogation usually involves

damage caused by one person or entity to a second person or entity.

The damaged person (or "first party") could turn the

claim into their insurer, but would have to live with the

consequences of having file a claim, such as a loss of claim-free

credits, increased rates, or, depending on their prior claim history,

possible non-renewal. If the loss was caused by another

person/entity (a "second party"), the first party would

expect the second party (or their insurer) to repair or replace their

lost or damaged property.

Things don't always resolve themselves so easily

however. If the second party is uncooperative, the first party

may have no other choice but to turn the claim in under their

insurance. Their insurer will assign an adjuster to review the

claim, ensure it is covered under their policy, and arrive at a

settlement. If possible, the first party's insurer (let's call

them Company A) may try to "subrogate" against the second

party or their insurer (Company B). Company A is standing in

for the first party, as they have incurred the cost of repairing or

replacing whatever is damaged.

Once something goes into subrogation, the first party

is usually out of the loop on further developments with the claim.

However, a claim in subrogation can still have an impact on

them. If their insurer has difficulties collecting, their file

for the claim can still be left in an "open" status.

This won't mean much to the first party unless/until they try

to move coverage.

At that time, the new carrier will ask for "loss

runs" from the past insurers. There are a number of things

on these loss runs that could lead the new insurer to issue

cancellation on the new policy: any claim that wasn't originally

reported on your application, open claims, a large past claim (even

if closed), frequent claims or even multiple claims of the same type.

So a claim that went into subrogation and has been

hanging in limbo for months or years, long after the first party's

damage was repaired or replaced, can still have lingering affects.

Which leads us to our sample claim on this subject.

The Incident

A bar owner has to escort a patron out of their building because they

were aggravating other customers. He led her outside and waited

in the doorway as the woman got into her car. As she drove away

she hit the garbage corral, spilling garbage as well as grease from

traps, then hit the side of the building causing a part of the wall

to separate from the foundation.

The insured reluctantly notified his agent of the

incident, while hoping the woman's auto insurance would cover the

damage she caused. In the meantime, the insured hired a

contractor to clean the grease spill in his parking lot and got

estimates on his building damage. Within a few days, his

insurer had started a claim file and gathered documentation of the

damage.

The bar owner's insurer shelved their claim file after

a couple of weeks, waiting for the woman's insurer to handle the

damages. A week and a half later (now nearing a month after the

incident) the woman's auto insurance wasn't covering the damages

(it's unclear on what grounds) and worse, the city was threatening to

shut the business down until repairs were made to ensure the building

was safe for the public to enter. But not just any repairs had

to be done, the existing walls had to be torn down to comply with

current code. A relatively simple repair had just

turned into a fairly substantial renovation.

The insured was out of options; he had to rely on his

insurer to cover the damage.

They did, $8900 from them and the $1000 deductible

from the insured, but the story didn't end there. The insured's

company "subrogated" against the woman for the next 28

months, recovering $2200 of the nearly $10,000 in damages she caused.

However, the woman was sent to jail on other charges, and wasn't

slated to get out for another 10 months. The company kept their file

open, so that they may decide to continue subrogation when the woman

was released.

As of today, the claim is still open, a whopping 6 and a half years

after the incident.

Conclusion

To the best of our knowledge, despite being listed as

"open" for the last 78 months this incident has never

prevented or otherwise interfered with the insured obtaining

insurance coverage. Although it easily could have, and it's

possible it still may, one day. Which would no doubt come as a

surprise to the insured who has probably long stopped caring about

the woman who hit his building.

There will presumably come a point where the insurance company

decides to wash it's hands of this matter, but with judgments in

their favor, they'll continue to pursue the woman who caused all this

damage.

There's also a valuable secondary lesson in this example about

Ordinance & Law coverage. The original estimate for repair

only was in the $3300 range. However, the city mandated that

the whole wall be torn out and replaced to comply with current code.

Since the whole wall wasn't damaged, this would have been out

of pocket expense had the insured not had an Ordinance & Law

Endorsement on his Property Policy with a $25,000 limit.

|

|

|

|

|

What Happens 473 Times an Hour?

According to the Department of Transportation, traffic accidents happen

about that many times an hour across the United States. Are your

personal auto limits up to par? Or are you carrying low-limit,

cut-rate coverage?

We

offer a full-line of personal lines coverages for four home, auto,

boats, motorcycles, RVs and more. Give us a shot at your next

renewal to see how we compete.

|

|

Carrier Corner

We represent over 15

insurance carriers directly and have access to many more via brokers,

but you may only know one or two that we deal with. Each issue,

we'll highlight one of our valued partners in this space.

AmTrust

Financial is an "A" (excellent) rated carrier that

does business nationwide. They have a couple of divisions,

Technology Insurance and UBI.

We've

used Technology for years for a variety of Workers Compensation

classes. They have a wide-ranging appetite, write Work Comp on a

monoline basis and offer very competitive rates.

UBI

is a newer arm of AmTrust and targets Commercial Lines accounts in the

restaurant, auto repair, retail business & offices, commercial

property, distributing, grocery store, and manufacturing industries.

A

great feature AmTrust offers on their website is their library

of Loss Control documents. The Food Handling

Guidelines in this issue are just one example of the type of detailed

information available for free on their website.

|

|

Our

office will be closed Monday, September 3rd in observance of Labor

Day. We'll resume normal business hours on Tuesday, September 9/4. Our

office will be closed Monday, September 3rd in observance of Labor

Day. We'll resume normal business hours on Tuesday, September 9/4.

|

|

Bret

Dixon Insurance recently became a Trusted Choice Agency. Learn

more about it here. Bret

Dixon Insurance recently became a Trusted Choice Agency. Learn

more about it here.

|

|

![]()

![]()